Insights

A collection of our recent articles, white papers, webinars, reports and videos.

TAS Group earns again its place in the 2021 IDC FinTech Rankings

Milan, September 14, 2021 – TAS Group, (Italian Stock Exchange: TAS), a global provider of innovative solutions in card management, digital payments, financial messaging and capital markets, has announced that it has been ranked among the Top 100 in the 2021 IDC FinTech Rankings for the 13th consecutive year. This annual vendor ranking represents the leading hardware, software and service providers to the financial services industry from around the world. Vendors are ranked based on 2020 calendar year revenues attributed to financial institutions.

“Being named in the IDC FinTech Rankings is a significant accomplishment, demonstrating a provider’s commitment to the success of its financial institution clients,” states Marc DeCastro, Research Director at IDC Financial Insights. “The IDC Fintech Rankings, now in its 18th year, is the global standard list of fintech providers to the industry, and we congratulate the 2021 winners.”

Executive Chairman of TAS Group, Dario Pardi, remarked, "We are proud to be firmly positioned, year after year, between the top financial technology providers in this prestigious ranking. 2020 was a year marked by extraordinary events and consequently particularly demanding and challenging. Nevertheless, we closed it with significant growth in revenue and margins, thanks to our continuous commitment to investing in human capital and offering renewal. This enables us to successfully bring competitive and technologically advanced solutions to the Financial Industry."

The Financial Services ecosystem, an industry in which IDC Financial Insights forecasts worldwide spending on IT across the globe to reach $590 billion (USD) by 2025, is changing at an unprecedented pace. Well-funded new market entrants, as well as big tech companies, have raised the bar for all providers. TAS Group’s efforts are heavily focused towards accelerating challengers’ next-gen financial experiences implementations, while supporting incumbent customers in meeting disruption with modernization and staying agile and responsive through TAS’s outstanding technology and expertise.

At Eurosystem level, TAS keeps strengthening its key role in supporting Europe’s financial community meeting the deadlines of the T2/T2S Consolidation in 2022 and the wider upcoming challenges, such as the migration towards ISO20022 and the new centralized ECMS infrastructure planned to go live in 2023.

In the Issuing and Acquiring domain, TAS continues to lead the way towards the seamless convergence between cards and alternative payments through its cloud-native, Open API-based platform PayStorm, adopted by a growing FinTech customer base throughout Europe and the Americas.

Among TAS’s strengths is the flexibility to adapt to the needs of customers and partners, guaranteed by its solutions and delivery models that promptly evolve with new regulations, market trends and technologies.

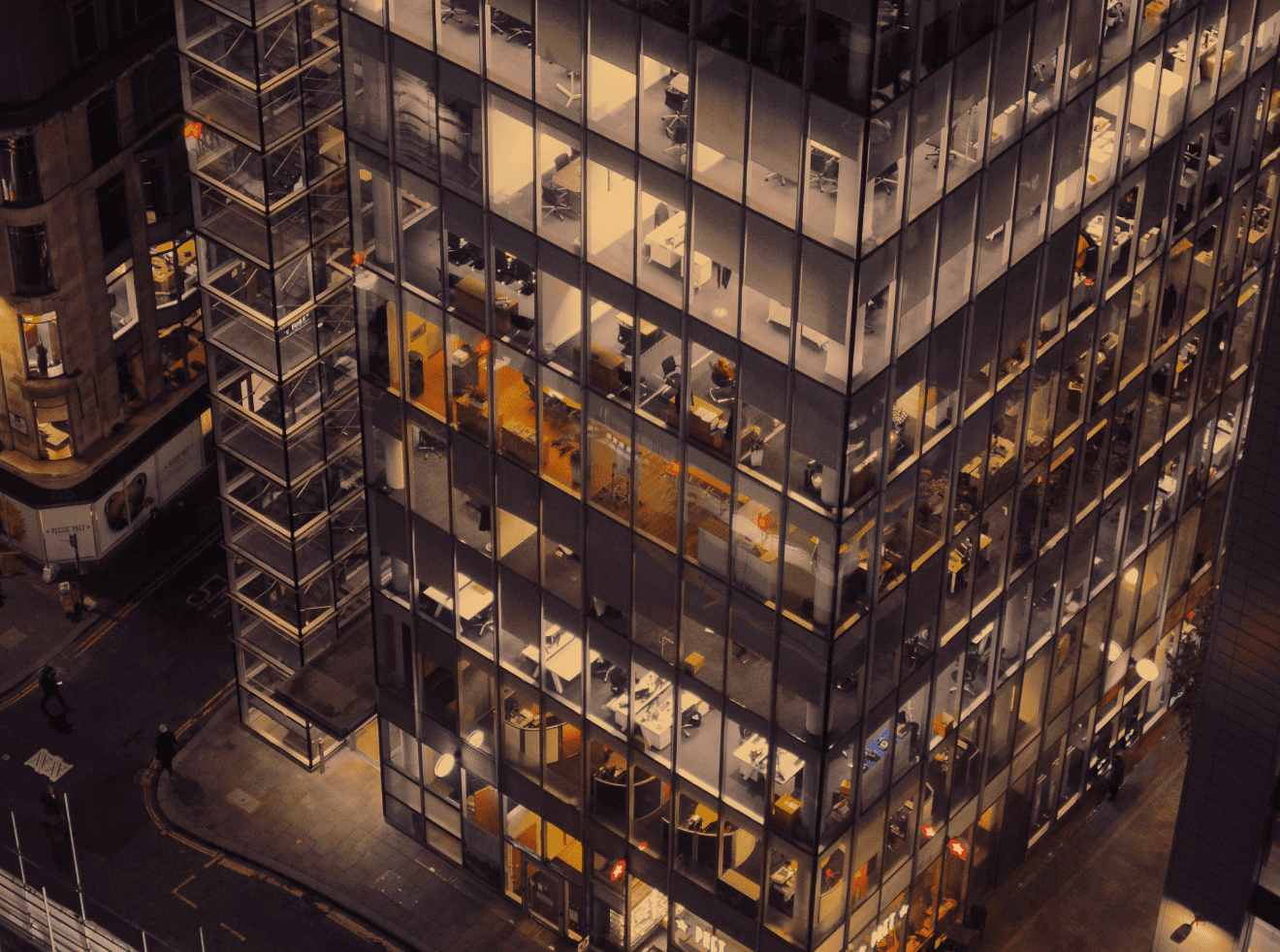

The Covid-19 Pandemic and the Liquidity Management Ecosystem

This short paper, recently issued by the EBA Liquidity Management Working Group (LMWG), highlights the major trends that the pandemic helped crystallise in the liquidity management ecosystem and outlines the questions that financial institutions will have to address as they continue to support their corporate clients.

TAS Group has been part of EBA’s Liquidity Management Working Group for several years already, in order to contribute with its domain expertise to the group’s mission to improve liquidity managers’ understanding and ability to face ongoing market developments as well as related technical, operational, regulatory and organisational challenges.

The migration of liquidity management practices into the digital area and to real-time processes can’t wait longer. The pandemic crisis has shown that, going forward, corporates need technologies and services that can be more readily adopted or more easily adapted to handle unforeseen situations.

EBA members can download the full report on the EBA Member Portal

Excellent economic results for TAS Group in the half-year report, compared to last year’s first semester. Revenues up to 29.7 million (+ 13.1%) and Ebitda up to 5.6 million (+ 33.2%)

The Covid-19 Pandemic and the Liquidity Management Ecosystem

This short paper, recently issued by the EBA Liquidity Management Working Group (LMWG), highlights the major trends that the pandemic helped crystallise in the liquidity management ecosystem and outlines the questions that financial institutions will have to address as they continue to support their corporate clients.

TAS Group has been part of EBA’s Liquidity Management Working Group for several years already, in order to contribute with its domain expertise to the group’s mission to improve liquidity managers’ understanding and ability to face ongoing market developments as well as related technical, operational, regulatory and organisational challenges.

The migration of liquidity management practices into the digital area and to real-time processes can’t wait longer. The pandemic crisis has shown that, going forward, corporates need technologies and services that can be more readily adopted or more easily adapted to handle unforeseen situations.

How PSPs are navigating change in a challenging payments landscape

TAS conducted a survey, in partnership with Bobsguide, to learn how PSPs, including Credit Institutions and other Payment organisations around the world, are reacting to the changes and challenges in today’s emerging payments landscape.

The report highlights the themes having a big impact on the payments industry right now: instant payments, ISO 20022, and liquidity management, and contains insights into global technology investment strategies, cloud adoption trends, the main challenges currently seen by the payments community and more.

Digital transformation progress in the European Banking Community – now more than ever

TAS Group has proudly sponsored two key EU conferences in June, Payments CEE Summit and EBAday 2021, that have clearly shown how deeply the acceleration in digitalization was able to positively impact the banking DNA.

With over 1000 professionals registered at the CEE Summit, connecting primarily but not only from the Balkans, and over 2000 delegates participating to EBAday 2021, the paramount annual conference curated by the European Banking Association, all hot payment trends were deeply debated by speakers coming from all segments of the stakeholders landscape: incumbent banks, challengers, paytechs, payfacs, regtechs, regulators, corporate clients, market infrastructures, academics and market research companies.

Hottest in the agenda: Instant Payments and their convergence with card payments, Request to Pay, Buy Now Pay Later, Fraud Detection in the Real-time era, ISO 20022 migrations, API enablement, and many more core topics, including the power of the Payments as a Service paradigm as a way to accelerate the banking modernization journey.

In case you missed our speeches at the conferences, by Dragan Spanovic, VP Sales TAS Eastern Europe, and and Mario Mendia, SVP TAS International, you may learn more about TAS Group’s 35+ years expertise as a PayFac in the evolving European Financial Services Market on our website.

TAS Spotlight Open Banking

In this video Marco Pozzo, Senior Business Development Global Payments of TAS Group, shares his point of view regarding the changing scenarios and the arising challenges in the Open Banking era…

Readily Integrate Real-time Fraud Detection within IBM Z-based Payment Systems without Impacting SLAs

WEBINAR

Detecting fraud within payment systems is one of the top challenges for IT organizations. Integrating fraud detection applications with payment systems can be complex and impact SLAs. IBM and TAS/Mantica have just simplified this effort.

IBM has partnered with TAS/Mantica to bring together the power of their Adaptive Intelligence Platform and Fraud Protection Solution with IBM Watson Machine Learning for z/OS. This impressive combination helps organizations monitor and detect payment fraud in real-time, before a transaction completes, with minimal impact to SLAs.

TAS/Mantica models can be readily deployed through the Watson Machine Learning for z/OS scoring service. The sophisticated models can help organizations drastically reduce the implementation effort of a customized fraud prevention/detection system.

Watson Machine Learning for z/OS scoring includes RESTful APIs and Java and CICS integration that benefit from the high security and performance of the IBM Z platform. Mantica Spark and customized machine learning models, ported to Watson Machine Learning for z/OS, enable scoring directly within an IBM Z application. IBM testing showed performance, measured against different CPU capacity, revealed single-digit millisecond response times and a complete exploitation of available specialized engines. The solution also maintains model quality and performance over time as new fraud patterns emerge.

Join this IBM webinar to learn how these innovative technologies help deliver valuable insight, at the point of transaction, by readily deploying fraud detection models within IBM Z transactional payment applications.

The webinar will be presented by Eberhard Hechler, Executive Architect, IBM and special guest speaker Amedeo Borin, CEO Mantica Italia.

TAS Spotlight Payment Schemes Connectivity

In this video Gianpiero Caretti explains how connectivity needs have evolved for businesses…

Contact us

Get in touch to discover how we can help in achieving your business goals